Now that the deadline for making AB 1513 Safe Harbor payments has passed, here are a few important thing to keep in mind:

Safe Harbor Report

Now that you have issued your payments, do not run the Safe Harbor Report again for all employees with the box checked to Create Safe Harbor Detail File. This will overwrite the information that you have used to generate the safe harbor payments, including the links from the employee information to the safe harbor checks that were issued. If you lose this information the only way to retrieve it may be by restoring a backup.

A future update will include a read-only setting to lock down the Safe Harbor Detail file and prevent and additions or changes to this information. Keep in mind that the law requires you to retain your payroll records and other information used to calculate the payments until December 2020.

Handling Inquiries

If you have an employee that believe that they should have received a safe harbor payment but didn’t, you can run the Safe Harbor Report for that single employee (again, do not use the option to create the detail file). If the report does not show any checks for the safe harbor time period, the employee may have worked but did not have any piecework wages. If there were piecework wages, the employee may have been paid correctly for the break (if using the actual sums due method) or the amounts may have been more than 4% of the employee’s wages (when using the 4% method). In either case, if the report shows a negative total due, the employee was not due a safe harbor payment.

It is up to you whether or not to provide the employee with a copy of the Safe Harbor Report, and how much detail you want to go into in explaining how Safe Harbor payment amounts were calculated.

If for some reason the report shows a positive amount and the employee is due a payment but one was not issued, you can issue a payment to the employee at that time. After investigating whether or not the employee has an account in the Safe Harbor Employee file, run the Safe Harbor Report for that employee only with the Create Safe Harbor Detail File box checked and select the Add option when the program asks if you want to add or replace the information in the detail file. You can then create a safe harbor check and print a statement for that employee only.

W-2’s

Employees that receive a safe harbor payment will need to be issued a W-2. If you have not already ordered additional W-2’s to account for this, go to the Payroll->Year End Tax Reporting->Count Employees With YTD Wages option to get a current count of the number of employees with wages in 2016.

Safe Harbor Payments to the DIR

As far as we know, the DIR will not accept payments for safe harbor payments that you are unable to deliver to employees after the December 15th deadline. Therefore, checks that are returned after this date should be handled the same as other uncollected payroll checks. You will need to report these wages on your quarterly report and year end reports and issue W-2’s to employees. If employees do not return to collect the wages, and you are still unable to locate the employee you will need to forward the funds (after the appropriate dormancy period) to the California State Controller’s unclaimed property fund.

A future blog post will include instructions and recommendations for handling unclaimed payroll checks

How Employees Get Funds From the State

If you have forwarded Safe Harbor funds to the state and employees are asking how they can collect those funds, direct them to the nearest Labor Commissioner’s office. A list of these offices can be found here. The Labor Commissioner’s office will verify that they are owed money that has been deposited with the Unpaid Wage Fund and assist them with the required paperwork.

The Labor Commissioner will only be able to disperse the funds to the employee. If the employee requests it, you may still need to provide the employee with a statement showing how the calculations were made to arrive at the gross wages paid (the Safe Harbor statement), as well as account for the payroll deductions (print a check voucher for the safe harbor check that you issued).

1095-C Reporting

An update to the HR program may be needed so that the 1095-C logic does not include Safe Harbor checks. Safe Harbor checks are identified with the pay period from 7/1/2012 to 12/31/2015. Employees that only have safe harbor checks issued in 2016 did not actually work in 2016 and should not have a 1095-C created.

After doing additional testing, we will post information on our blog if an update is necessary.

Using the Safe Harbor Report for 2016 Wages

Some customers that are concerned about whether they have correctly issued payments for breaks in 2016 have asked whether or not the Safe Harbor Report can be run for 2016 payroll. The answers is yes and no. You can run the report for any time period, and using the Actual-AB 1513 Calculation option for the Safe Harbor Method should identify any employees that were unpaid or underpaid for breaks based on the rules that went into effect January 1, 2016.

However, if you want to issue checks to employees for any shortfalls, do not use the Safe Harbor Report to create the detail file for your 2016 payroll (see first item above). Contact Datatech customer support so that we can gather more information, determine if additional programming is needed and recommend what procedures to follow. (If additional programming is needed, it will likely not be possible for this to be done until February.)

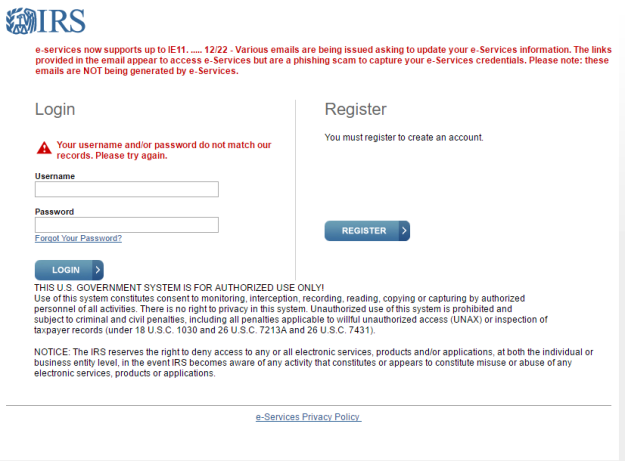

For those of you who are dealing with updating your IRS e-Services password/passphrase, be aware that the IRS has posted a warning on the e-Services login page about various emails that are circulating which ask you to update your e-Services information. The links that are provided in these emails appear to access e-Services, but are actually a phishing scam designed to capture your e-Services credentials.

For those of you who are dealing with updating your IRS e-Services password/passphrase, be aware that the IRS has posted a warning on the e-Services login page about various emails that are circulating which ask you to update your e-Services information. The links that are provided in these emails appear to access e-Services, but are actually a phishing scam designed to capture your e-Services credentials.